The Pros and Cons of Releasing Equity With a Remortgage (VIDEO)

Once your mortgage term is up you’ll have the option to remortgage to a distinct or different lender with (hopefully) better rates of interest and terms. As part of any remortgage, most lenders give you the option to release some of the equity of your house and still have it as cash lump value. While this is a very tempting option for a number of people, especially those who are in debt or require a home renovation, a new car, or other luxuries, there are numerous pitfalls with going down this kind of route.

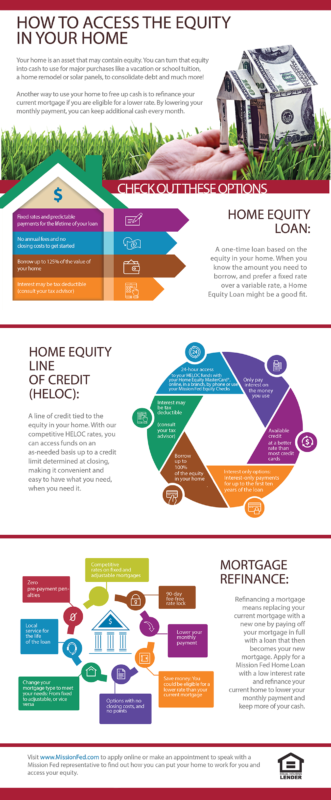

Home Equity

Let us take a glance at an example of whether issuing equity is financially feasible over a personal loan for a similar amount. Let us assume a couple wants to release $10,000 using their home equity. At a 3% interest rate on their remortgage, this will add around $50 – $60 extra 30 days to their mortgage bill over a 20-year period. In contrast, a personal loan of the identical amount over a five 12 months period will add around 3 times that amount – $180, 30 days over a 5-year period (assuming a mortgage of around 4. 5% APR).

On paper, this looks great and appears like the most sensible option. On the other hand, over the borrowed period, releasing the equity will set you back around $7, 000 in awareness, whereas the personal loan will be around $2,000 which is usually $5,500 less.

Home Equity Line of Credit – Video

Equity in Remortgage

As a long-term plan, the releasing of equity in the remortgage is a bad idea due to the very large amount of total interest accrued despite the fact the monthly payments are far lower. If your goal is to be debt-free and mortgage-free immediately then releasing equity simply does not work properly unless that money is essential for emergency purposes.

Ultimately, remortgaging and releasing a dollars lump sum from your house has pros and cons, and whether you should take action or not depends very much on the current financial situation.

Pros

- To be able to release a large cash swelling sum, tax-free from the house equity. This could be employed for any purpose.

- Monthly payments will be low due to low-interest rates (at the time of writing) along with generally longer payback periods.

- Cash lump sums may very well be used to consolidate debts and leave you with small monthly payments for the assimilated amount.

Cons

- You are merely prolonging your mortgage. If your goal is to be mortgage-free ASAP then releasing equity isn’t a good option.

- The total amount of interest you would pay over the loan period is considerably more than the amount you would pay were you to acquire a personal loan for the same volume.

- Releasing equity can mean that some lenders won’t give you preferable rates and you’ll end up with a higher interest rate than normal.

- Remortgaging your house and releasing cash from that can make financial sense for some situations, however, if your goal should be to spend that money on luxuries or stuff that aren’t essential, then from a financial point of view getting a personal loan can make more sense providing the monthly outgoings are within your means.