How to Improve Your Credit Score to Get an FHA Loan and Buy a House (VIDEO)

Your credit score reveals more than you probably realize; you’re spending behavior, how you manage finances, and whether you make late payments or pay on time. Good credit will help you save money in the long run. When you have a higher FICO score, you are able to make that big home purchase or a car. And pay it off with a lower down payment, have a lower interest rate, and make those lower monthly payments more doable, (more money in your pocket). And the way lenders view your score: the higher the score and the lower the risk. Impact the factors that lenders use when determining your interest rates.

Where Does Your Credit Score Fall?

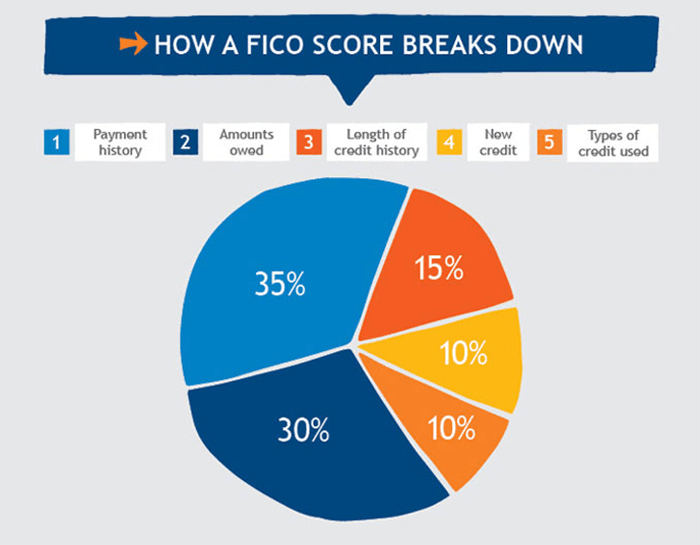

Your credit varies based on fluctuations and several factors; your credit utilization is the amount you borrow compared to the total amount of FICO you have available, and how much you utilize your credit. So say that dollar-wise, you owe a higher percentage of what you are allowed on your credit line. You will take a huge hit on your credit score.

And just like receiving grades on your high school report card, you will receive a credit grade based on your credit utilization. Credit score ranges from “very poor” below 600, to “excellent” 700-850.

When you have a better credit score, you will have the advantage of qualifying for better mortgage rates. Although there are other types of loans your FICO score may not always be as significant. “While many lenders use FICO Scores to help them make lending decisions. Each lender has its own strategy, including the level of risk it finds acceptable for a given credit product. There is no single “cutoff score” used by all lenders and there are many additional factors that lenders use to determine your actual interest rates.”

Credit Score Ranges From 300 to 850

Based on the best interest rates for conventional loans – Fannie Mae and Freddie Mac require a lot of focus on whether your score is 760 or higher. With the Federal Housing Administration or Veterans Affairs loan. The focus is on 700 plus, and the impact of a lower score won’t be as substantial.

With a government-insured FHA mortgage, your credit score can be as low as 500. VA mortgages do not require a minimum FICO score, though lenders typically look for a score of 620 or higher. And loans backed up by the Agricultural Department require a minimum FICO score of 640.

New FHA Loan Requirments – Video

There is some leniency on credit scores, but the loans are more expensive as you are required to pay private mortgage insurance. Plus the upfront and an annual mortgage insurance premium. To see the lender’s perspective and it’s best looked at as though you are about to loan a friend money. Typically you will not see that money again, lenders use PMI as insurance to protect themselves in the event you go into default.

Jumbo loans exceed conforming loan limits and are one way to buy a high-priced or luxury home. They are imposed by Fannie and Freddie and you must ideally have a credit score of 760 or above.

Take These Basic Steps Towards Building Your FICO Score

Nearly 7 million people suffer from bad to moderate FICO levels. And have an average credit score of 550 to 620 score.

Here are some ways to build and gain a better credit score:

- Pay off debt and keep your credit balances low. Regularly check your credit score, you can obtain a copy from each of the three creditors (Equifax, Experian, and TransUnion). For free once a year at AnnualCreditReport.com

- Get current on your bills and pay your bills on time. Keep good debt on your credit for a longer debt history, and pay off any late payments as soon as possible. Making one late payment can really impact your score.

- Opening up a new account will increase your FICO line and your limit. The more available credit you have, the better it is for your credit score. Compare rates and when you need to pull out a loan to pay off current credit debt to keep a lower interest rate.

- Becoming an authorized user will let you increase your credit and can enable you to raise your score. As long as you hold onto the card, and make sure to be held at a lower risk.

- Don’t waste your time by calling your utility providers. Keep in mind, even though you are paying utility payments on time, it does not help you. But when they become delinquent it backfires against you when your account gets sent over to a collection agency.

How Your Credit Score Will Affect Your Mortgage

Your credit score will affect your eligibility for getting a mortgage loan and determines what rate you will pay. A higher score will reflect better FICO history and allows you to obtain lower interest rates. It is a vital component, so be sure to check your credit for any errors and correct them before applying for a loan.

All in all, there is a 1.6% difference between the best credit range and the 620 credit range on a 30-year fixed-rate mortgage. This is a difference of $100 per month per $100,000 of the mortgage amount. With a $300,000 mortgage, you would pay about $1,400 per month at a 4% interest rate versus $1,700 at 5.6%.

Having a good credit score will help you save money, and improve your life in making those mortgage payments hassle-free and have an easier life. A higher score will allow you to pay lower balances and loans, which means more money to a bank in your wallet or you can put towards paying off your balance.

It also enables your negotiating power. You have the freedom to shop around and receive great offers from a different array of companies. Which gains you bargaining power when most creditors won’t nearly budge on loan terms with bad FICO.

Because your borrowing limits are ranged on your income and your credit, banks are also willing to let you borrow a higher capacity of money.

The Differences Between Fixed-Rate Mortgage Loans and an Adjustable-Rate Mortgage (ARM) Loan

“The difference between a fixed-rate and an adjustable-rate mortgage is that for fixed rates the interest rate is set when you take out the loan and will not change. With an adjustable-rate mortgage, the interest rate may go up or down.”

Arms typically start at a lower rate and adjust after the introductory period, and usually, the payments spike up. Your interest rate is tied to an index, and your payment will go up as the index interest increases. Sometimes your payment will go down, but not all are true for all ARMs. Some ARMs will even have a cap on the highest interest rates as to how high they can rise, as well as how low they can go.

Be sure that you can afford those high rates when your payment spikes up the maximums allowed under the contract. Do not assume you will be able to sell or refinance before your loan rate changes.