First-Time Home Buyer Beginners Guide: Money-Saving Tips, Credit Score

Are you ready to buy a house for the first time? It has to do a lot with your state of mind and the state of your bank account, and getting both into shape will definitely require some changes on your part. One important factor to consider is your credit score. Before applying for a mortgage, you’ll want to ensure that your credit score is in good standing. This will not only increase your chances of being approved for a loan but also secure a lower interest rate. In addition to working on your credit score, it’s important to save for a down payment and consider the overall costs of homeownership. Keep reading for more tips on preparing yourself for your first home purchase.

Here are the 4 things you should do when scoring your dream home:

1. Get Rid of an Indulgence or Two

Saving a good amount of money for a down payment is key to buying a home. Save the ideal 20% by reducing your monthly expenses. You should cut out these 4 daily expenses that add up by the end of the month, according to the experts at the Local Records Office.

• Coffee: The average coffee cup at Starbucks is about $3.50 if you spend $3.50 every day for a month that will add up to over $100, instead make instant coffee at home, most groceries stores sell instant coffee for under $10 and it will last all month.

• Cable: Cable is an expensive luxury, not a right. The average cable bill bundle costs Americans over $100 a month that’s over $1,200 a year. Save your money and stop watching reruns of Friends and go for a walk instead, it’s FREE.

• Stop eating out: Eating at restaurants on the regular adds up quickly. The cost of food is going up and restaurants know it. A burger with fries and a soda at a restaurant like Yard House or Chili’s Grill will cost you about $17 and that’s not including the beer or refreshing margarita you might afterward.

• New clothes: Wear your used clothes for longer, your slightly faded blue jeans still have more to go. Purchasing new clothes will lower your bank account in no time. Try something different like shopping at your local thrift shop, you’ll save money and your purchase helps a good cause.

2. Open a Savings Account Just for Your Down Payment

Opening a savings account just for the purpose of putting in money for your down payment is a great start. You can start by putting in money every week, soon enough you will get into the habit of putting money in. Next thing you know you will have enough money for a down payment.

By cutting down on certain things, saving money will be easy and can positively impact your credit score. One helpful tip is to leave your savings account card at home when going out to avoid spending your savings on unnecessary things. Additionally, maintaining a good credit score is important for achieving financial stability and reaching your goals, such as buying a home. Paying bills on time, keeping credit card balances low, and monitoring your credit report regularly are all ways to improve your credit score. Remember that a good credit score can lead to better interest rates on loans, credit cards, and mortgages. It’s important to start building good credit habits early on to ensure a healthy financial future.

3. Do a Trial Run at Homeownership

Homeownership is more than coming up with the down payment you still have to pay your mortgage every month. By doing a trial run at homeownership you will be able to see if you can pay your mortgage on time and still pay for other bills like electricity, water, groceries, car payments, and others.

Test out your cash flow as a homeowner by setting aside the anticipated amount of your monthly home-related expenses and see if you can get by without digging into your saving account. The worst thing that can happen is not preparing for homeownership and you can’t afford to pay your basic bills.

4. Know Your Credit Score

Credit is used almost everywhere. Your credit will determine if you can walk out with a new Television from an electronic store for no money down and your credit score will determine if you qualify for a credit card.

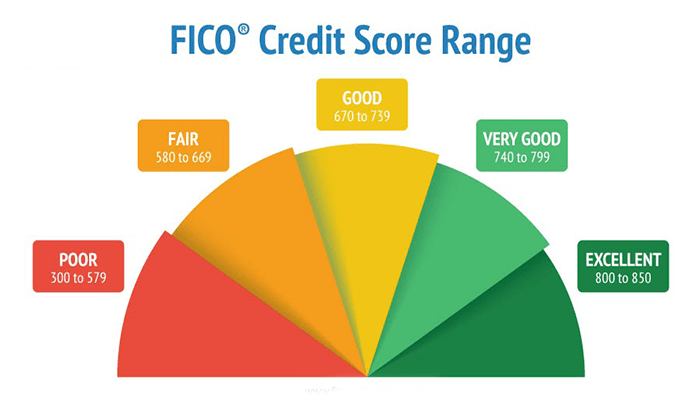

Credit scores run from 300 to 850. Bad credit scores are in the range of 300 to 579; this range will make it difficult to borrow money when you need it.

580 to 669 range, the fair credit range will give you a bit more options when you want to apply for a credit card.

670 to 739 range, will lower your interest rates and will give you a wider range of choices. Excellent credit ranges from 740 and up. Excellent credit will give you access to the best credit cards and will definitely lower your interest rates (if any).